Universal Account Servicing FAQs

- Visit https://uportal360.com/login

-

Enter your Account Number and Access Code

- Choose to Validate your Birthday

- Or click on "Answer a Different Question"

- Validate the last 4 of your SSN

- If you cannot login, call Universal Account Servicing, LLC Customer Care: 1-888-233-2302

You can find your Access Code:

OR, you can search for your Access Code:

- On the login screen, click on I forgot my Username or Password.

- Select the Consumer role.

- Use the search feature to enter the e-mail address associated with your Account to retrieve your Access Code.

For more information, visit the Where can I find my Access Code? FAQ.

If you cannot get past the validation option, there may be an error with the data we have on file. This error requires a call to Universal Account Servicing, LLC Customer Care: 1-888-233-2302

- Phone: 1-888-233-2302

- Monday - Friday: 7AM - 7PM Central Time

- Address: PO Box 12027, Parkville, MO 64152

- Email: [email protected]

- If you cannot login, call Universal Account Servicing, LLC Customer Care: 1-888-233-2302

- From the Menu, select Your Account, then select "Contact Info"

- Your current information will be displayed on the screen

- Select on Edit to modify any contact information

For ease of use, our system assigns a randomly generated account number and access code. In addition, another data point must be provided to access the account. This meets industry practices to have multi-factor login access.

Security software may recommend you change your password or indicate it may be compromised. UAS can assign a new Access Code if requested. Please know that due to the length of the code and being numeric, this warning is unlikely to change. Any attempt to access your account would also require the additional question to be answered correctly.

Your Payment Card and ACH information is not stored in our portal. No one can access your full payment information even if they have managed to compromise your account. All that is seen is the last 4 digit. We never store the CVV anywhere in our database.

A Co-Applicant will have full access to the Account along with the primary account-holder. After completion of the contract signing process, a copy of the Contract document packet will be provided to the Co-Applicant. The packet will include a Welcome Letter, introducing Universal Account Servicing, LLC (UAS) and the uPortal360 platform, along with information needed to access the Account online. When a Co-Applicant attempts to login to the uPortal360 platform, they will be asked security questions, such as the Birthday or Last 4 of SSN of the primary account-holder. As an Authorized Party on an Account, a Co-Applicant will have the same access and authority on the Account as the primary account-holder when communicating with UAS.

Yes, from the Menu, select Your Account and then select "Agreement Details". Terms, Interest Rate and a copy of your contract are available.

Please contact Universal Account Servicing, LLC Customer Care: 1-888-233-2302. Depending on what information that you are needing to update, we will require that you send us a copy of one of these documents that includes the information that you are requesting to be changed:

Please send your documentation to:

PO BOX 12027

Parkville, MO 64152

This notice is specific to student loan borrowers regarding certain alternative repayment and/or hardship arrangements for which you may be eligible. Your private student loan provider does not provide alternative repayment or hardship arrangements for retail installment contracts. As the third-party student loan servicer, UAS does not provide alternative repayment options and/or hardship arrangements unless directed to by your private student loan provider. For further details, please contact us at (888) 233-2302 or contact your student loan provider directly to discuss what options may be available.

An explanation of how your payments are applied can be found in your Agreement or Contract.

Generally, UAS applies payments for certain credit products as detailed below.

Bank Installment Loans and Retail Installment Contracts: We generally allocate all payments

first to interest, then to any unpaid fees, and then to the balance of outstanding principal.

Retail Installment Credit Agreements: We generally apply payments first to outstanding finance charges (interest),

fees and any past due amounts. After outstanding fees and past–due amounts are paid, the Minimum Monthly Payment as

well as any excess over the Minimum Monthly Payment, will be applied as follows: First to special promotional financing

term amounts in the order of expiration, soonest first, next to interest-bearing amounts, in interest rate order, higher rates first (if applicable).

- From the Menu, select Your Account, then select "AutoPay"

- Select Setup AutoPay

-

If you do not have a Payment Method on file, add a Checking Account or Credit

Card

- See "How do I manage Payment Methods?" for help

- Select your Payment Method for AutoPay

- Select Minimum Payment or enter an Override Payment Amount for accelerated payoff

- Read the Disclosure

- Sign by using your finger on a Phone or Tablet, or click and hold the left mouse key as you draw a signature

- Select Submit

- AutoPay Success Message will be displayed.

- From the Menu, select Your Account, then select "AutoPay"

- Click on Opt-Out

- From the Menu, select Your Account, then select "Payment Methods"

-

You can "Add" Methods at anytime

- Click Add

- Select Checking or Credit Card

-

Checking Account

- 9 Digit Routing Number

- Account Number

- Billing Address

- Select Save

-

Credit Card

- 16 Digit Card Number

- Exp Month and Year

- Billing Address

- Select Save

-

Edit - Pencil Icon

- Allows you to update your Billing Address

-

Delete and Copy - Two Pages Icon

- Used to change your Card Number or Expiration Month/Year of the Card on File

-

Delete - Red Trashcan

- Removes the Payment method from our system

-

Delete Payment Method used for AutoPay

- If you delete a Payment Method that is used for AutoPay, you will get an error

- You must first Opt-Out of AutoPay, See "Can I Opt-Out of AutoPay?"

Yes, from the Menu, select Your Account and then select "Transactions". You will see a list of all Payment history as well as any other types of transactions.

Complete = Posted to your Account

Declined = Transaction was declined and payment was not posted

Yes, from the Menu, select Your Account and the select "Charges".

Open = Signed charge with a balance

Paid = Charges that have been Paid in Full

- From the Menu, select Your Account, then select "AutoPay"

- Select "Update"

- Choose your Method of Payment or Add Another Payment Method

- Select Minimum Payment or enter Override Amount

- Sign

- Select "Submit"

Certain payment limitations may apply to your account. Please contact Universal Account Servicing, LLC Customer Care: 1-888-233-2302 to resolve your issue and complete your payment.

Payment Method Validation Troubleshooting

You received a message stating, something went wrong. Before you search for the applicable error code, please review the troubleshooting steps below to fix the most common issues.

- Payment Method (Type of payment method selected must match card being used)

- First name and Last name are spelled/entered correctly

- Address (street number, apart/unit number, city, state, zip code, country). Address associated with card must match the address entered

- Checking account and bank routing number were entered correctly

- Credit/Debit card number is entered correctly

- CVV/CVC is entered and correct

- Expiration month/year is correct (confirm the card is not expired and entered in correct format mm/yy)

- Reach out to your bank / card issuer - confirm the transaction was not flagged for potential fraud or was blocked. After resolving with them, retry.

- Use a different payment method.

| Error Message | Resolution |

|---|---|

| Account Closed | Check processor (RPS) has declined the transaction because the account has been closed. |

| Auth Service unavailable | An unexpected internal error occurred. Contact [email protected] for assistance. |

| Billing City does not match zip code | Check city and zip code entered and confirm they are correct. |

| Billing State does not match zip code | Check state and zip code entered and confirm they are correct. |

| Card not accepted by merchant, please try different card | The card has not been accepted by merchant; please use new card. |

| Cardholder state or zip code is required | Check and confirm both state and zip code are entered. |

| Check processing temporarily offline. Please try again shortly. | Internal system error, please wait and try again later |

| Credit card has expired | Expiration date for card shows in past. Review to confirm expiration is correct and/or enter new card. |

| Declined - Stop Payment (RPS) | Check processor (RPS) has declined transaction because a stop payment was issued by this account. Please contact bank for details. |

| Duplicate Check | Check processor (RPS) has declined transaction due to a duplicate check. Please contact bank for details. |

| Error storing payment method record | The system was unable to store the payment method. Could be a temporary system issue or payment method no longer exist. Review the information and try again. |

| Funds cannot be released for this transaction | The transaction type does not support releasing funds, or the transaction has passed the time limit for releasing funds. Contact card issuer for assistance releasing a hold on card. |

| Invalid account type specified | Review payment method and select either checking or savings. |

| Invalid Card Look Up | A valid card lookup string was not provided. Please try again. If problem persists, contact [email protected] |

| Invalid card number | The card number entered does not appear to be valid. Review card number entered and confirm it matches card. Do not include spaces. |

| Invalid check format specified | Check format must be a valid 3 character format code or left blank |

| Invalid checking account number | The checking account number does not appear to be valid. Review number entered and confirm it is correct. |

| Invalid expiration date | Must be in MM/YY format: review and correct to match your card's expiration date. |

| Invalid Routing number | The bank routing number does not appear to be valid. Review number entered and confirm it is correct. |

| Invalid schedule | Invalid schedule specified. Check documentation for a list of valid schedule designations. |

| Invalid transaction data | Missing or invalid fields were detected. Review all fields and enter missing/incorrect information. |

| Issuer Declined |

Your bank declined the transaction — this could be due to insufficient funds, an expired card, or other restrictions.

What to do: Double-check your card details, make sure you have sufficient funds, and contact your bank to resolve the issue or try another payment method. |

| Merchant does not accept this type of card | Card entered is not accepted. Review list of acceptable cards and enter new card. |

| Merchant does not accept transactions from (country) | Country entered is not acceptable. Enter new card with acceptable country. |

| Payment details missing | Customer payment method must have credit card data or check data completed. Payment method cannot be created without information. |

| Payment method is not a check | Account type and Check format may only be set on payment methods that are check. The default payment method is not a check. Review and correct necessary information. |

| Payment method not added because verification returned (response);(errorcode); (reason). | Payment method not added as the credit card data did not return an approval when running an authorization. Contact [email protected] for assistance. |

| Processing error, please try again | An unexpected error occurred when processing your payment. Please resubmit payment. |

| Processor temporarily unavailable | Processor returned an unexpected error. Contact [email protected] for assistance. |

| Received error from check processor | Check processor returned unmapped error. Contact [email protected] for support. |

| REJECTED CONTACT CUST |

Your card has been used more than twice within the past 24 hours and has been

declined by the card issuer.

What to do: Use a different payment method to complete your transaction today. Or, contact your bank to clear the rejection "Issuer Decline," then try again after 24 hours. |

| Requested payment method not found | Payment method specified was not valid. Review payment details match to that of payment method selected. |

| Session timed out, please re-login | Your current session timed out. Return to login screen and enter credentials to try again. Timeout duration can be adjusted in settings. |

| Stolen/Forged Checks (RPS) | Check processor (RPS) has declined transaction as the account has reported stolen/forged checks. Contact your bank for details. |

| Suspected Fraud |

Your bank flagged this payment as potential fraud and blocked it for your protection.

What to do: Contact your bank to confirm the transaction is legitimate. After resolving with them, retry the payment or use a different card. |

| System temporarily unavailable | Unable to load required resources to store transaction record. Retry transaction and if problem persist, contact [email protected] |

| Temporarily unable to process transaction. Please try again shortly. | An unexpected internal error occured. Please wait and try again. |

| Transaction Declined (RPS) | Check processor (RPS) has declined transaction, no reason provided. Contact bank for assistance. |

| Transaction exceeds maximum amount | Maximum amount of payment allowed is $20,000.00. Please adjust your transaction appropriately. |

| Unable to apply changes, please retry | Failed to commit changes to transaction (internal error). Retry transaction and if problem persist, contact [email protected] for support. |

| Unable to create customer payment method from requested transaction | System was unable to convert the requested transaction into a customer payment method. The original transaction data might not be sufficient. Check all requested fields are completed and correct. |

| Unable to load payment method | The system was unable to store payment method. Could be a temporary system issue. Try resaving payment method. |

| Unable to locate requested payment method | The system was unable to load the requested payment method. The method was most likely deleted by another process. Re-enter payment method information and save. |

| Unable to perform requested action | An unexpected internal error occurred. Contact [email protected] for assistance. |

| Unable to process transaction | Unexpected processor error occurred. Review payment method and retry transaction. |

| Unable to retrieve list of banks | An unexpected error occurred while trying to retrieve bank list. Retry to confirm information. If problem persists, contact [email protected] for support. |

| You have tried too many card numbers, please contact merchant | The transaction has been blocked due to the amount of card numbers used. Contact [email protected] for support. |

| Your billing information does not match your credit card. Please check with your bank | Review your address and confirm it matches the billing address associated with the card being used. |

Didn't find what you were looking for? Contact our support team at (888) 233-2302 or [email protected].

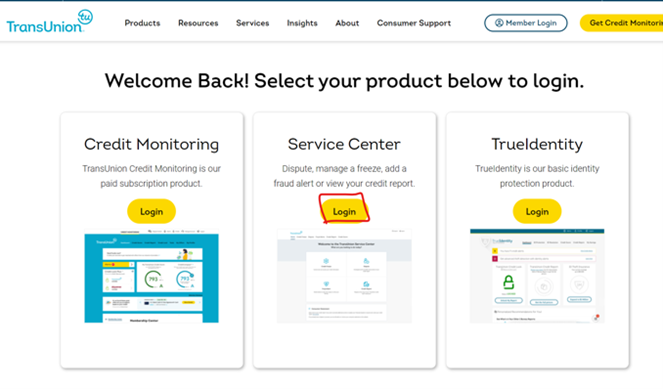

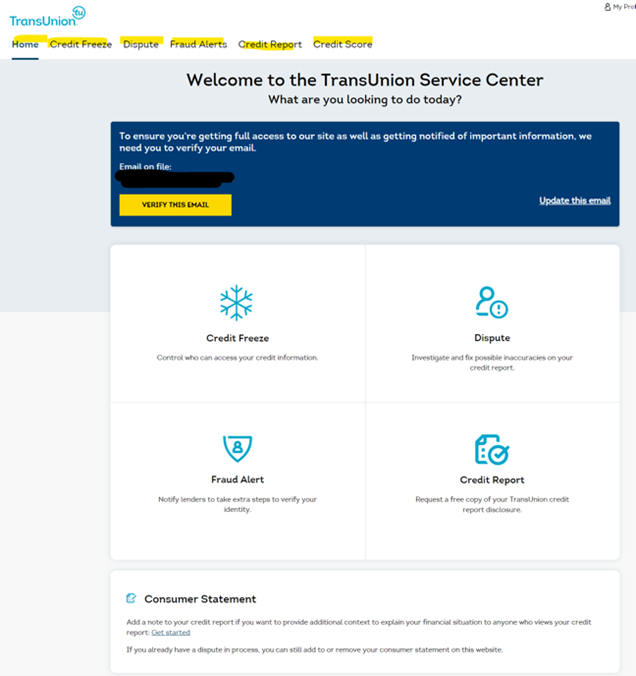

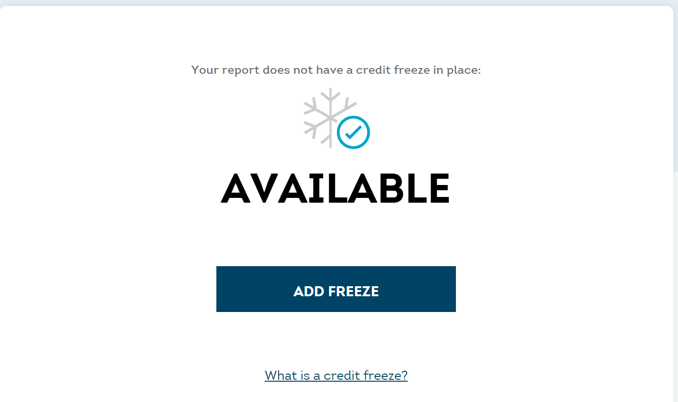

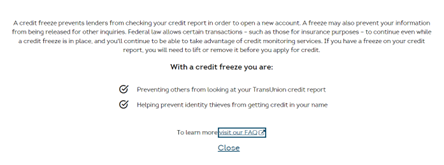

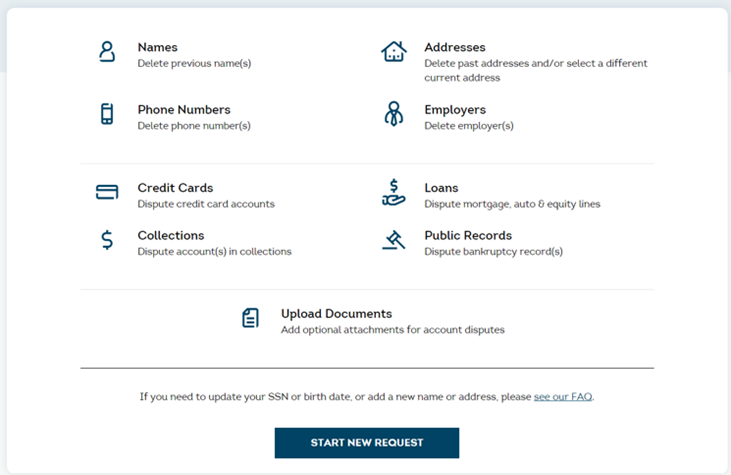

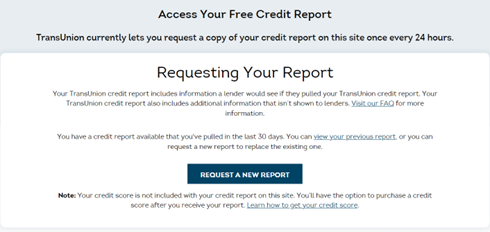

You can contact each of the three major credit bureaus (Experian, Equifax, and TransUnion) at any time to make sure your information (Name, Address, Credit Freeze, Fraud Alerts) are accurate and up to date.

Below are the steps to create a TransUnion account, manage credit freezes, review your report, and how to create a dispute to update your data on file (if your information is not up to date). Remember, each credit bureau (Experian, Equifax, and TransUnion) has its own website that allows you to perform similar actions. The credit bureaus do not share this information, so you will need to check them individually. Since UAS primarily uses TransUnion, it's best to start with them. Experian may also be used.

|

|

|

|

|

|

|

|

|

|

|

|

Accepted Card Types